What Florida Homebuyers Need to Know About the New 2025 Flood Disclosure Law

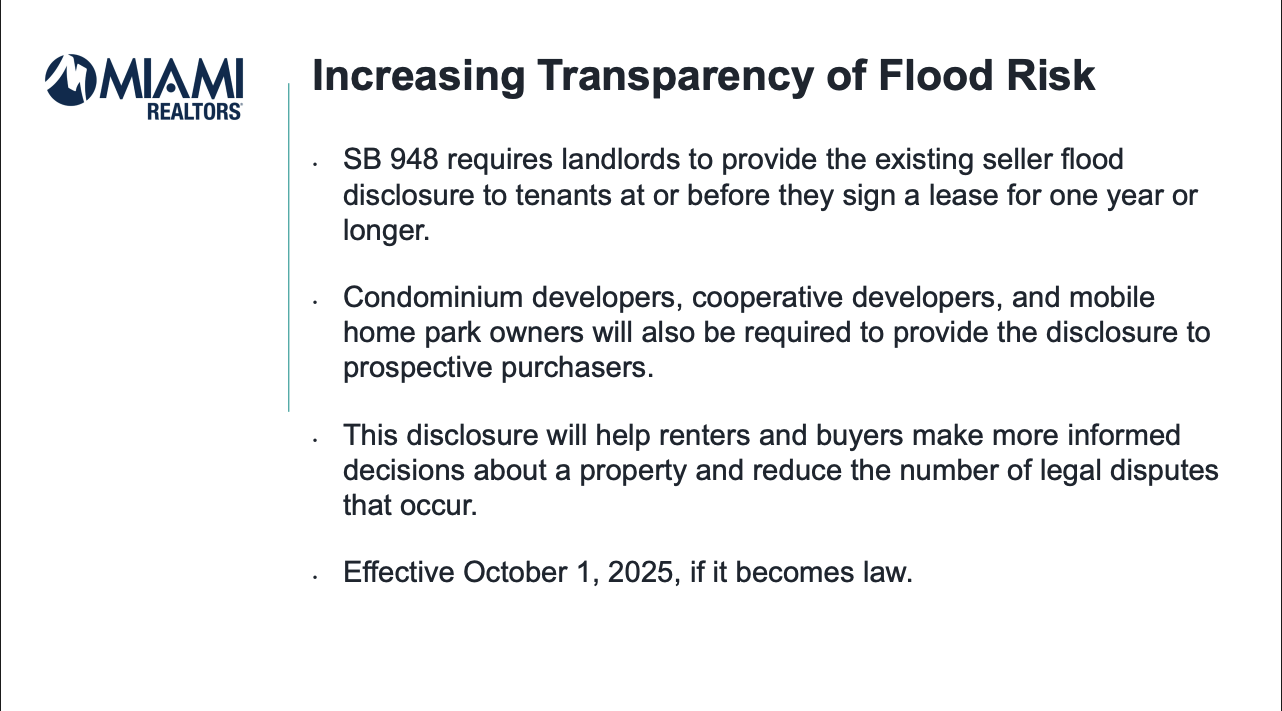

Beginning October 1, 2025, a new Florida law (House Bill 1049) officially changes the way flood risk must be disclosed in real estate transactions — and it’s a big win for transparency.

For the first time, home sellers in Florida are required to disclose flood history and flood insurance information in writing before closing. Whether you’re buying or selling, understanding these changes will help you avoid surprises and make more informed decisions.

What Sellers Must Now Disclose

Under the new law, sellers must provide a written “Flood Disclosure Form” answering key questions, including:

- Has the property ever flooded or sustained flood-related damage?

- Has the owner ever filed a flood insurance claim or received federal disaster assistance?

- Is the property located in a FEMA-designated flood zone or Special Flood Hazard Area?

- Is there existing flood insurance coverage, and if so, can it be transferred?

This form must be completed before a buyer signs the contract, ensuring full transparency early in the process.

Why This Matters for Buyers

For buyers, this new requirement brings peace of mind.

Florida’s low-lying geography means flood risk can vary drastically — even within the same neighborhood. The disclosure gives buyers a clearer picture of:

- Potential insurance costs

- Maintenance risks tied to water exposure

- The long-term resilience of the home

Armed with this knowledge, buyers can make smarter choices and budget realistically for flood protection.

What This Means for Sellers

If you’re selling a property, accuracy matters. Failing to disclose known flood history could now expose sellers to legal liability after closing. The safest move?

Gather documentation early — such as prior insurance claims, FEMA letters, or elevation certificates — and discuss them with your Realtor before listing.

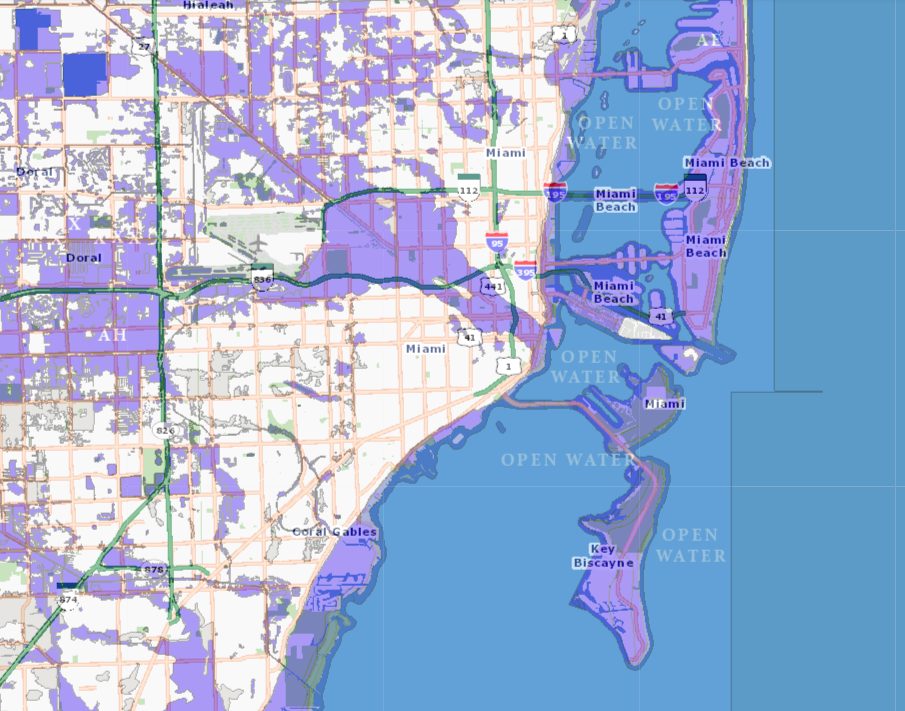

Looking Up Flood Risk Locally: Miami-Dade & FEMA Maps

Because flood risk is location-specific, one of the best tools buyers, sellers, and renters can use is local flood zone mapping.

In Miami-Dade County, you can view digital flood hazard maps (FEMA Flood Insurance Rate Maps, or FIRMs) through the county’s Flood Zone Maps web portal, which is based on FEMA data. Miami-Dade County

- Enter your address in the interactive tool to see your property’s flood designation (e.g. AE, VE, X, etc.). Miami-Dade County

- If you prefer, you can also download FEMA maps via the FEMA Map Service Center from Miami-Dade’s site. Miami-Dade County

- For official confirmation or printed versions, contact the Miami-Dade Flood Zone Hotline or the county office. Miami-Dade County

By referencing local maps, clients can see whether their specific property falls in a Special Flood Hazard Area (mandatory flood insurance zones) or lower-risk zones. This adds concrete insight beyond just disclosures.

🌴 Bottom Line

Florida’s 2025 flood disclosure law reflects a growing focus on climate resilience and consumer protection.

As flood risks rise, transparency helps everyone: buyers gain confidence, sellers avoid disputes, and communities become more prepared for the future.

If you’re planning to buy or sell in Miami or anywhere along the coast, I can help you understand how these new rules affect your transaction and what proactive steps to take.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link